Debt structure

Sandvik's debt structure includes:

- Bonds, Medium-Term Notes (MTN)

- Bank loans

- Commercial papers

| Outstanding amount |

Equivalent in MSEK |

||

|---|---|---|---|

| Long term | 71% | ||

| Medium-Term Notes MSEK |

0

|

0 | |

| Medium-Term Notes MEUR |

2,145 MEUR

|

24,683 | |

| Bank loans MUSD |

0

|

0 | |

| Bank loans MEUR |

150 MEUR

|

1,726 | |

| Bank loans other |

142 MSEK

|

142 | |

| Short term | 29% | ||

| Commercial paper MSEK |

4,051 MSEK

|

4,051 | |

| Commercial paper MEUR |

38 MEUR

|

433 | |

| Medium-Term Notes MSEK |

5,000 MSEK

|

5,000 | |

| Medium-Term Notes MEUR |

105

|

1,208 | |

| Bank loans other |

272 MSEK

|

272 | |

| Back-up facilities | |||

| Revolving Credit Facility MSEK | 0 MSEK | 0 | |

| Credit Facility MEUR | 0 MEUR | 0 | |

| Total | 37,515 | ||

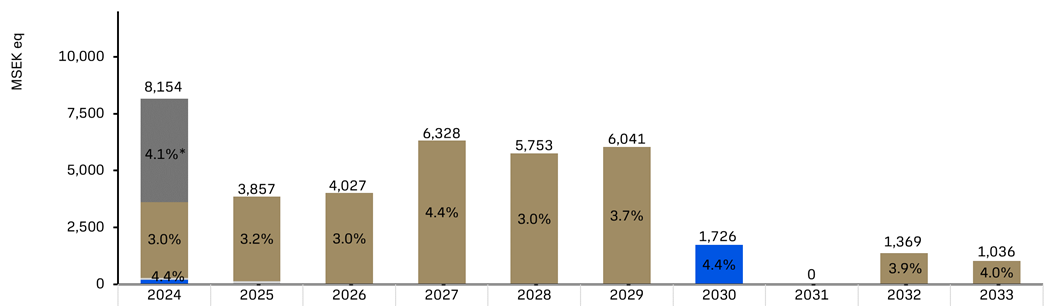

Loan maturity profile March 31, 2024

| Type of debt | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 |

|---|---|---|---|---|---|---|---|---|---|---|

| Commercial paper | 4,537 | - | - | - | - | - | - | - | - | - |

| Bonds | 3,345 | 3,714 | 4,027 | 6,328 | 5,753 | 6,041 | - | - | 1,369 | 1,036 |

| Bank loans | 200 | - | - | - | - | - | 1,726 | - | - | - |

| Sub-loans | 72 | 142 | - | - | - | - | - | - | - | - |

| Total | 8,154 | 3,857 | 4,027 | 6,328 | 5,753 | 6,41 | 1,726 | - | 1,369 | 1,036 |