Navigating the transition to electric vehicles

The shift towards electric vehicles heralds massive changes for automakers and their suppliers. Fewer, but more complex, components and tools will be required.

Electric vehicles (EVs) are the key technology to decarbonize road transport, a sector that accounts for over 15 percent of global energy-related emissions, according to the

Electric vehicles (EVs) are the key technology to decarbonize road transport, a sector that accounts for over 15 percent of global energy-related emissions, according to the

International Energy Agency (IEA). Driven by consumer demand and new regulations aiming to limit emissions from internal combustion engine (ICE) vehicles, the auto industry is gearing up for a seismic shift.

Sandvik's role in the automotive sector

The automotive industry and its subcontractors are an important customer segment for Sandvik, according to Eduardo Debone, Head of Product Area Emerging Offer at Sandvik Coromant.

“The automotive industry is a big technology driver and a beacon of innovation even to other industries in pushing new and cost-effective technologies for mass production. Meeting their needs is a ticket for Sandvik to lead the way and position ourselves in a premium category.”

ICE and EV production

Debone points out that production of conventional ICE cars will continue for the foreseeable future. Consequently, most established automakers are likely to produce EVs as well as ICE-powered autos. And they will need a type of dual-platform approach in their manufacturing facilities. This strategy is beneficial to Sandvik, says Debone:

Investments in new facilities and upgrades and retrofitting of existing plants represent an opportunity for Sandvik as a premium supplier of machining solutions.

In addition, hybrid cars fitted with two parallel connected energy systems require an even greater number of components and tools, and so do the increasingly popular four-wheel drive cars.

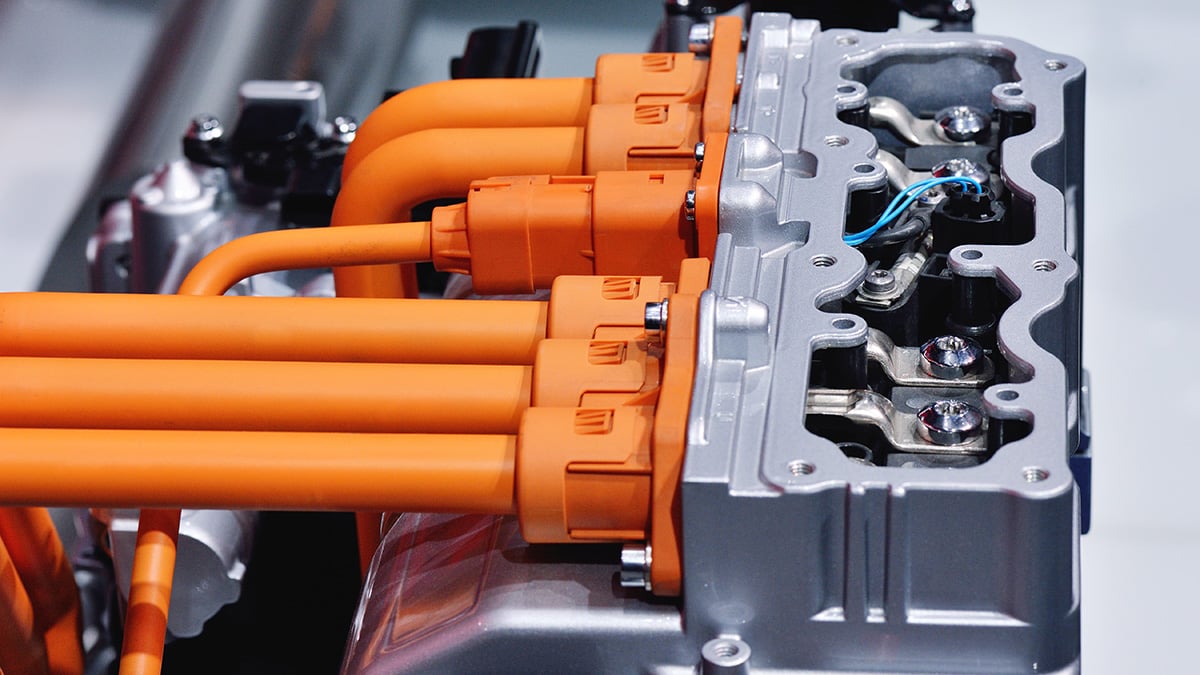

EV’s component complexity

On average, a car with an ICE is made up of 33,000 moving parts, but an EV has just 13,000. How does this affect the demand for tools and machining solutions? “While EVs require fewer components than ICEs, some of the tools required are much more complex and specialized, and come with a higher price tag,”says Debone.

One example of a production method that has a large bearing on tooling is that leading EV makers are increasingly building chassis and frames in one piece. Megacasting is the process of die-casting nearly the entire complex underbody of an EV and may involve an injection of up to 80 kilograms of molten aluminum into a mold where it is formed into a component, released, and then quickly cooled.

“These frames often require long, overhanging tools that are lighter and at the same time more complex, to enable the precision and final form complexity required,” says Debone and points out that “the cost per tool item tends to be higher for EVs than for ICEs.”

The need for servicing of tools used in EV production also tends to be greater. The superhard polycrystalline diamond (PCD) tools, for example, rely on servicing to recover the investment.

“You don’t discard or circulate a used PCD tool in the same way you would a tungsten carbide insert,” says Debone.

Flexible manufacturing for diverse EV features

To justify a higher price tag, electric cars also come in a greater variety and with more options and features than most ICE cars.

“To meet this trend, EV makers need a somewhat more flexible manufacturing system. Machines and processes look vastly different from the early days of auto assembly lines, while the tools used today need to be engineered in a way that allows them to be used for a greater number of different models than in the past,” says Debone.

As a result, Sandvik Coromant has refined its tool offering to suit EV makers. The turning and y-axis tools such as CoroTurn. Prime, and the PCD tooling range, are examples.

Whether EV plants are greenfield operations run by new players, or spin-offs from established automakers, digital manufacturing is the preferred choice. The solutions from Sandvik allow for end-to-end closed-loop manufacturing from pre-production to post-production.

In retrofitting machines in existing facilities, many automakers opt for digital investments to cut costs and stay competitive.

To conclude, Debone summarizes the effects of the shift to EVs on Sandvik: “More projects, new components and more complicated tools speak in favor of Sandvik. The auto industry disruption certainly helps to make us ready for shifts on this and in other industries as well. We gain traction.”